The budget and local services 2024/25

Frequently Asked Questions

The budget and your Council Tax

More information about Council Tax for 2024 can be found in the Council Tax Frequently Asked Questions area of the website.

The budget, your Council Tax and local services

– a summary

Click on image to enlarge

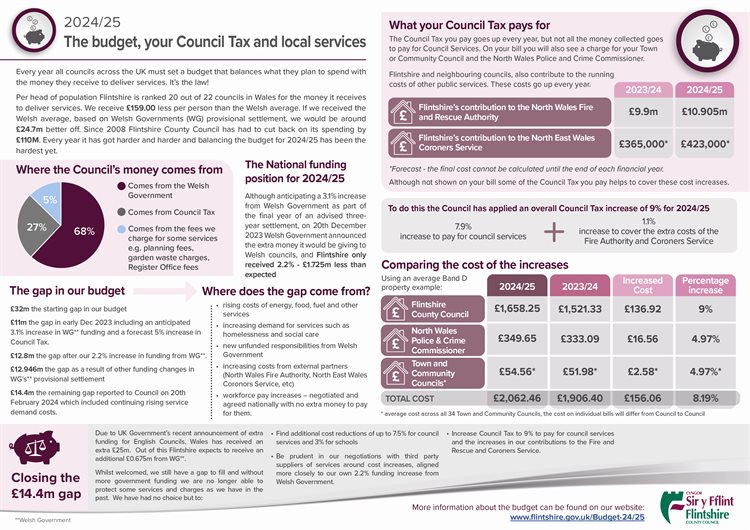

Why is there a gap in the budget, where does it come from?

The biggest part of the funding we receive (68%) comes from Welsh Government (WG) in the form of its Revenue Support Grant (RSG).

Since 2008, due to reductions in funding by United Kingdom and national governments, Flintshire County Council has reduced its spending by £110m so there are very few opportunities left to further cut back on spending.

The budget gap for 2024/25 comes from things like:

- workforce pay increases – these are negotiated and agreed nationally but councils are given no extra funding to pay for them

- costs of energy, food, fuel and other services

- increasing demand for services such as homelessness and social care

- new unfunded responsibilities from Welsh Government

- increasing costs from external partners e.g. North Wales Fire and Rescue, North Wales Coroners Service and the providers of social care services

How big is the gap for 2024/25?

Planning to set the budget for 2024/25 has been ongoing all year and as we have continued to forecast and plan, the gap has fluctuated.

Early in the year a starting gap of £32m was identified.

By September 2023 we had identified solutions that would reduce the gap by £18m. This was based on a forecasted 3.1% settlement in Welsh Government Funding and a planning assumption based on a Council Tax increase of 5%. This left a gap of £14m still to be found.

In early December 2023 the position was updated and the £14m gap had reduced to £11m.

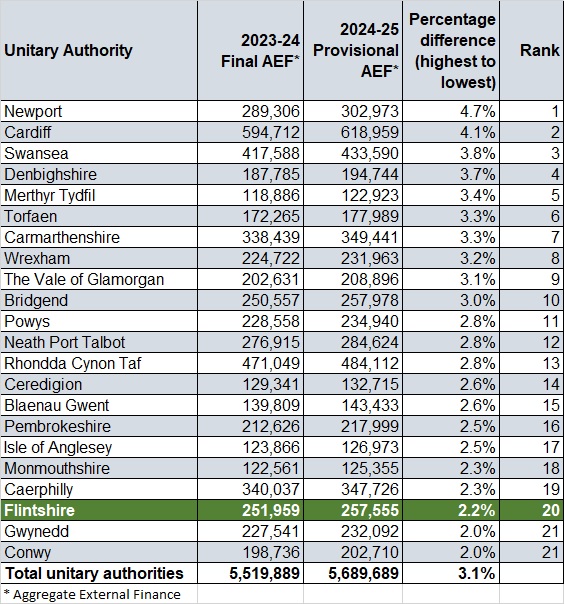

Welsh Government’s local government provisional settlement was received on 20 December 2023. Although the average increase in funding for local councils in Wales was 3.1%, as anticipated, the amount Flintshire will receive was lower at only 2.2%.

This means Flintshire, will receive £1.725m less than we had planned for which increased our budget gap from the £11m reported in December to £12.8m.

In addition to this reduction in our anticipated core funding, Welsh Government has also made changes to other things that impacted the Council’s budget. The 2.2% increase plus these other funding changes increased our budget gap further to £12.946m.

The final budget gap reported to Council on 20 February 2024 was £14.4m which included additional increased costs associated with continuing rising demands for essential services.

Are all Councils struggling to balance the books or is it just Flintshire?

In a recent Society of Welsh Treasurers survey, coordinated by the Welsh Local Government Association, it is evident that all Councils in Wales are experiencing the same financial challenges. For example, there is an estimated overspend of £220m across the 22 Welsh Councils in the current financial year and total estimated cost pressures of £809m for 2024/25.

Does Welsh Government give each Council the same amount to fund services?

When allocating its overall budget Welsh Government assigns a portion to fund council services. This money is then shared out between all 22 Welsh councils. The amount each council receives is worked out through the Local Government Funding Formula. This looks at things like the geographical size of the council, how rural it is, the size of its population, the economy of the area in terms of wealth and poverty.

Flintshire has the sixth largest population in Wales, however, under the Funding Formula, Flintshire is a low funded Council, positioned 20 out of 22 Councils for the amount of money it receives per head of population. This is £159 lower per person than the Welsh average. If Flintshire received the Welsh average, it would be around £24.7m better off financially.

What is the difference between Revenue and Capital expenditure?

The easiest way to explain the difference between Revenue and Capital is in household terms, where capital buys rarely purchased, big items (a house or car) and revenue pays for the everyday things to keep them running like heating, lighting, food, diesel, etc.

The Council uses its Capital to invest in things that will last a long time, things like improvements to school buildings or care homes. Revenue funding, as well as paying for day to-day things such as wages, heating and lighting also pays for all the day to day costs of things like weekly bin collections, care packages for older and vulnerable people, accommodation for the homeless, etc.

Although under existing rules it is possible to use Revenue funding to help support a Capital purchase, it is not possible to use Capital money to pay for Revenue costs. For example, if the Council sold a piece of land, the money received would be Capital and could only be spent on other Capital projects. It could not be used to pay for day to day running costs or expenses.

What steps has the Council taken in recent years to balance its books?

Over the past 15 years, Flintshire County Council has cut back on its spending by £110m. We've achieved this massive reduction by doing things like:

- a 50% reduction in senior management and their support

- a reduction in middle management posts

- administration and clerical posts and costs reduced by 40%

- 30% reduction in all service budgets (except Schools and Social Services) - some even as far as 45%

- office accommodation reduced by 20%

- the disposal of two large office buildings and 50% demolition of County Hall Mold

- six depots merged into one new and a more efficient facility at Alltami

- sharing buildings with partners such as North Wales Police in Holywell and Flint

- saving money in the way we buy and operate Council vehicles

- changing the way we provide services - Aura Leisure and Libraries, a new company created and run by former Council employees / NEWydd - a wholly Council owned trading company providing cleaning and catering services

- working with local communities where there has been interest to take on and run local services, e.g. Holywell Leisure Centre, Café Isa.

- NEW Homes - a wholly Council owned trading company providing homes for local people

- SHARP (Strategic Housing and Regeneration Programme) building new Council and affordable homes

- Double Click - a new social enterprise providing social services for adults with mental health issues and learning difficulties

- integrating services with other councils in the region to share costs e.g. education

- procuring or bulk buying with other councils to get better deals e.g. computer hardware

- annual review of fees and charges

Why can’t the Council use up the money it has in reserves to help balance the books?

When we refer to ‘reserves’ we are talking about the money the Council holds each year to pay for unexpected expenses or emergencies, for example the cost of an extreme weather event like Storm Babet and Storm Ciaran.

The Council doesn’t hold large reserves and like household savings once we dip into them to pay for something then the money is gone. The Council has increased its current base level of reserves to £8.981m which is only 2.44% of the Council Fund Revenue Budget. This is the Council’s last line of defence in the event of unforeseen circumstances and is very low compared to other councils in Wales.

Over and above the base level of reserves we have a contingency reserve which has been built up from previous years underspends. The estimated amount available is only £1.9m which does not give the Council very much resilience in the current financial climate.

The Council also holds various earmarked reserves which are set aside for specific purposes and can be drawn down as and when the additional spend occurs.

Who pays for the North Wales Fire and Rescue Service?

North Wales Fire and Rescue Service protects residents, businesses and communities across the region through preventive and responsive services including home safety, fire prevention and extinguishment, and responding to road traffic collisions, and other emergencies including severe weather.

Each year, the County Council has to pay into a combined fire service fund to meet the annual costs of the Fire and Rescue Service. This is known as the annual Fire Service Levy. For 2023/24 the Council paid a levy of £9.9m.

Although there is no Council Tax ‘precept’ shown on your bill for North Wales Fire and Rescue Service - part of the Council Tax you pay helps the Council fund the fire and rescue service.

North Wales Fire and Rescue Authority is also under pressure from increasing costs and it is expected that in 2024/25 North Wales councils will need to contribute more to its budget to help it balance its books. For Flintshire this additional amount is £0.969m.

Click here for more information about North Wales Fire and Rescue and the role of the Fire Authority.

Who pays for the North East Wales Coroners Service?

The North East Wales Coroners Service has a statutory responsibility to investigate a death reported to it which may be violent, unnatural, of unknown cause or where the cause of death arose in prison or otherwise in state detention. These investigations can lead to a type of court hearing, called an inquest.

The North East Wales Coroner’s Service is funded through contributions from Conwy County Borough Council, Denbighshire County Council, Flintshire County Council and Wrexham County Borough Council. The amount each council pays is related to the number of people who live in each county. Flintshire County Council has the largest population so pays the largest amount, 31%. Our contributions are paid quarterly and the total amount we pay in any given year is determined by the number and complexity of inquests which are held. In the financial year 2022/23 Flintshire’s contribution to the service was £351,000. By the end of the 2023/24 financial year we are forecasting that we will have contributed £365,000.

Although the full cost of the four councils’ contributions is not known until the end of the financial year, the coroner’s service is also experiencing risings costs for the services it needs to buy in, for example pathology services. This means that for 2024/25, as part of our share towards the overall running costs, Flintshire is expected to make an additional contribution of £58,000 over and above the 2023/24 costs. If this extra cost was to be added to Council Tax bills, based on an average Band D property, householders in Flintshire would contribute £1.02 extra per year (or 2p per week) to the North East Wales Coroners Service.

More information about the Coroner’s service can be found by visiting Denbighshire County Council’s website.

What do you mean by ‘savings’ are you referring to ‘cuts’?

In the past we have used the term ‘savings’, to describe the different things we have been able to do to find solutions to bridge the budget gap. By doing things differently we have been able to 'save' the council money and keep services running.

We have done this by doing things like:

- running efficient services and 'saving' money

- being more entrepreneurial in the way we do things

- reducing the amount of money services are given to spend

- increasing the amount of money we have to spend by charging for some services

After well over a decade, we have exhausted all our ‘efficiency’ opportunities and there are very few, options left open to us.

At the beginning of the 2023/24 financial year Flintshire was facing a £32m gap in its funding. By the beginning of December 2023 we had managed to reduce the gap to £11m. To achieve this £21m reduction we included a planning forecast of 5% increase in Council Tax and a predicted 3.1% increase in our funding from Welsh Government.

On 20 December Welsh Government announced its provisional budget settlement and Flintshire received the second lowest allocation of funding across Wales at only 2.2%. This significantly reduced amount, together with other notified budget reductions, increased our budget gap to £12.946m. The final budget gap reported to Council on 20 February 2024 was £14.4m which included continuing rising service demand costs. Without any additional funding Flintshire had no choice but to make some very difficult decisions in terms of “cutting” further the amount of money it currently spends on some services.

Why doesn’t the Council move out of County Hall and use smaller and less expensive office accommodation?

Two of the four office blocks at County Hall, Mold have been demolished already and we are in the process of drawing up plans for the demolition of the remaining two blocks.

Last updated: 4 March 2024